Solano County Property Tax

Secured Refunds - are those issued to taxpayers due to a reduction in the assessment of secured property resulting from a correction made due to an error appeal or event as determined by the Assessor. Solano county Tax Collector now offers a way for you to make monthly payments to pay your Secured Property Taxes.

Ive been around long enough to know that Valero Benicia Refinery routinely appeals its tax assessment and that Solano County has been known to roll over and give away the farm.

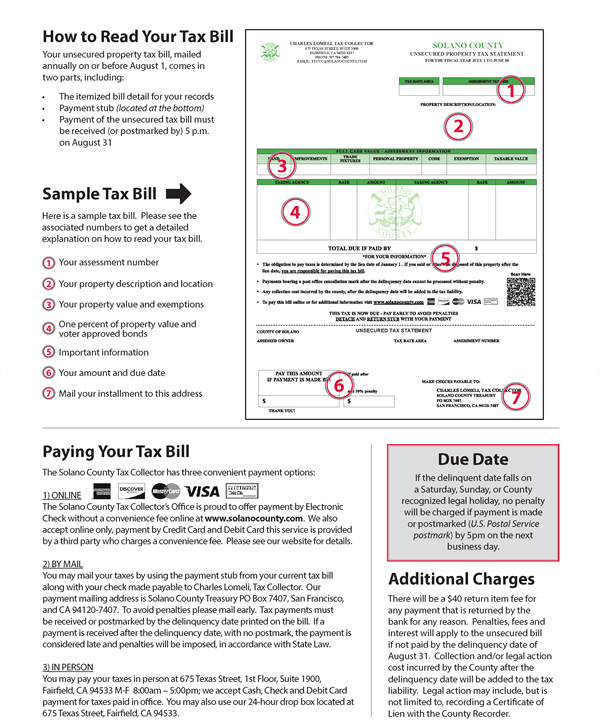

Solano county property tax. Property Tax in Solano County. Payments by credit card or debit card are provided by a third party that charges a convenience fee. Solano County collects on average 069 of a propertys assessed fair market value as property tax.

This can be either your secured or unsecured assement number. To visit during normal business hours we are located on the second floor of the Solano County Government Center at 675 Texas Street Suite 2700 Fairfield CA 94533-6338. If the home in question is your primary residence you may qualify for a homeowners exemption which will reduce your assessed value.

It is not the mailing address of the owner. For unsecured you can also use your Your Craft Number if you do not have your account number. Pay by Electronic Check with no convenience fee.

FAIRFIELD Genentech had its property tax valuation for 2010-20 reduced by 214 billion after a lengthy series of appeals of the original annual assessments. When are secured property taxes due in Solano County. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Solano County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Solano County California. SEE Detailed property tax report for 136 Newcastle Dr Solano County CA. Pay by Electronic Check with no convenience fee.

There are three types of refunds issued by my office. Can be used as content for research and analysis. To issue marriage licenses and to conduct civil marriage ceremonies.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Examples of Secured property are land and structure which include but are not. These records can include Solano County property tax assessments and assessment challenges appraisals and income taxes.

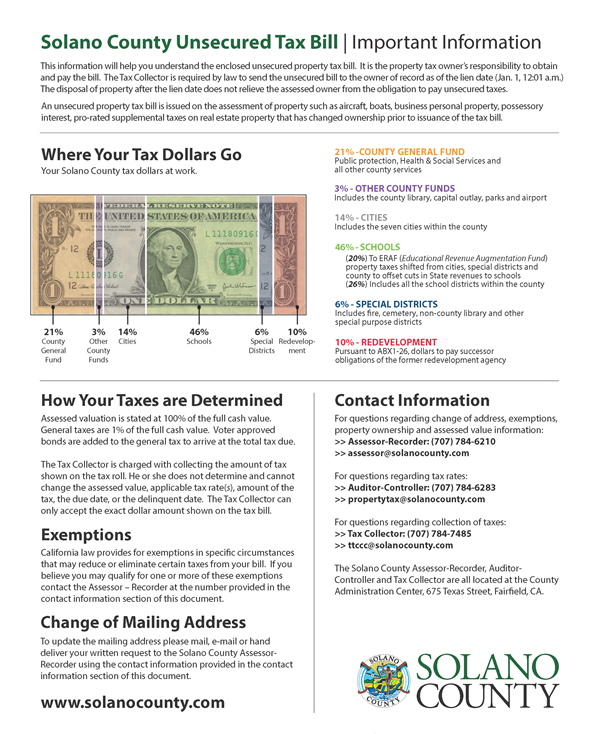

To provide financial services to county departments school districts and other independent agencies and districts. To file and maintain certain mandated documents. The Solano County Assessor-Recorders Office announced Wednesday it had reached a.

Please enter your Assessment Number. Property location is the physical location of the property also known as the Situs Address. To bill and collect real and personal property taxes.

Technical Contact Employee Services Maps Directions Acceptable Use. Property taxes are based on the assessed value of the home which is determined by the Solano County Assessors Office. Solano County property tax assessments keep an eye on this July 7 2020 Roger Straw BenIndy editor.

Our audit found an instance of noncompliance with California statutes for the allocation and apportionment of property tax revenues for the audit period. The median property tax in Solano County California is 2700 per year for a home worth the median value of 389800. Nevada County The median property tax also known as real estate tax in Solano County is 270000 per year based on a median home value of 38980000 and a median effective property tax rate of 069 of property value.

Note that 1168 is an effective tax rate estimate. -- All Cities -- Benicia Dixon Fairfield Rio Vista Suisun Vacaville Vallejo Other. Dear Taxpayers of Solano County.

It can be found on both your secured and unsecured Taxbill. Solano County has one of the higher property tax rates in the state at around 1168. Solano County Property Records are real estate documents that contain information related to real property in Solano County California.

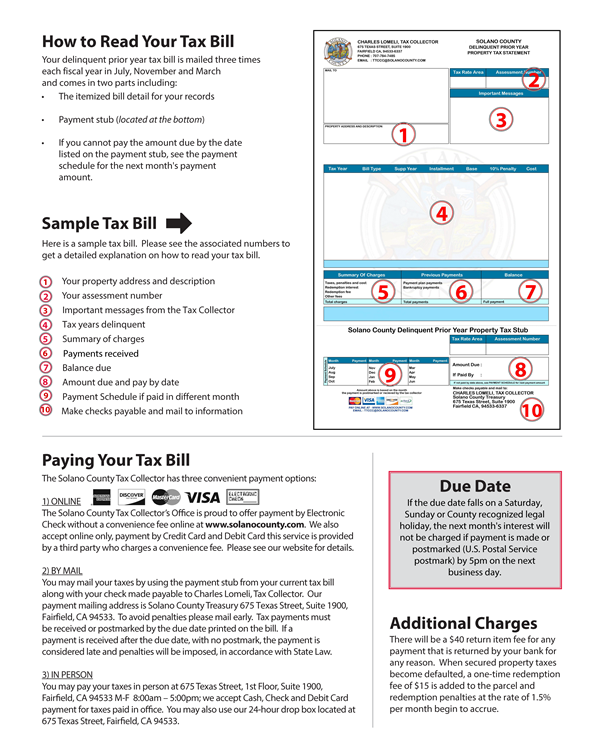

Payments by credit card or debit card are provided by a third party that charges a convenience fee. Solano County Secured tax bills are mailed annually not later than October 31. Solano County to allocate and apportion property tax revenues for the period of July 1 2014 through June 30 2017.

Solano county Tax Collector now offers a way for you to make monthly payments to pay your Secured Property Taxes. You may pay the entire annual tax bill when you pay your first installment or in two equal installments by the dates indicated on the tax bill. Solano County Property Tax.

PROPERTY THAT QUALIFIES FOR TAX RELIEF. Our Solano County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States. Please Fill In The Fields Below.

3 counties have higher tax rates. Collected from the entire web and summarized to include only the most important parts of it. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Proposition 13 enacted in 1978 forms the basis for the current property tax laws. We determined that the county incorrectly included unsecured. Solano County has one of the highest median property taxes in the United States and is ranked 227th of the 3143 counties in order of median property taxes.

Assessed value is calculated based. Property Tax Relief The Solano County AssessorRecorder and Treasurer-Tax Collector-County Clerks Office are working together to assist property owners who may be eligible for property tax relief for the portion of their property that was damaged or destroyed in the LNU Lightning Complex fire. Solano County TCCC Mobile Pay.

Please enter the Assessment Number or Property Address and our system will provide you with a list of available options. 53 out of 58 counties have lower property tax rates.

Tudor Style Home With Pretty Font Yard Tudor Style Homes California Homes Home

Solano County Offers Tax Relief To Property Owners In California

Pay Property Taxes Online County Of Solano Papergov

Free Covid 19 Testing Still Open To Anyone News Vacaville Ca

Job Announcement Appraiser Senior County Of Solano

Another Elderly Covid Death In Solano County 185 New Infections The Benicia Independent Eyes On The Environment Benicia News Views

Solano County Offers Property Tax Penalty Relief Due To Covid 19

Solano County Business Licenses

Fairfield Ca Land For Sale Property Id 331767114 Landwatch Hunting Wallpaper Duck Wallpaper Hunting Property

Solano County Assessment Role Shows Modest Gains During Pandemic The Vacaville Reporter

Solano County California Genealogy Familysearch

Solano County Unsecured Tax Bill

California Public Records Public Records California Public

222 Broadway Ph1 Oakland Mls 40632758 California Homes Patio Patio Tiles

Solano County Unsecured Tax Bill

Homes For Sale Real Estate In 77056 Houston Texas Homeswing California Homes Mediterranean Villa Curb Appeal

Solano County Delinquent Prior Year Tax Bill

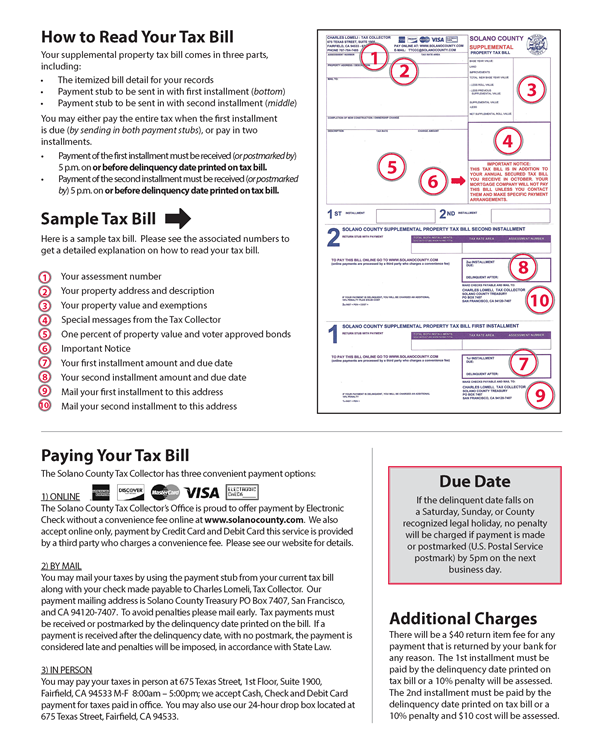

Solano County Supplemental Tax Bill

Post a Comment for "Solano County Property Tax"